Posts Tagged ‘obamanomics’

$1 Million/Day for 2,295 Years: Senate Bailout Plan…

The US Senate is set to pass a so-called “bailout bill” that amounts to $838 billion. To give that some sort of perspective, you’d have to spend a million dollars a day for two thousand, two hundred and ninety-five years to spend an equivalent amount. Of course, that doesn’t include the interest which will accrue on that staggering debt.

The US Senate is set to pass a so-called “bailout bill” that amounts to $838 billion. To give that some sort of perspective, you’d have to spend a million dollars a day for two thousand, two hundred and ninety-five years to spend an equivalent amount. Of course, that doesn’t include the interest which will accrue on that staggering debt.

How will this gigantic tab be paid? It’ll by paid by the US taxpayer: $6,2,36 per taxpayer, to be precise. That, of course, is on top of the $13,500 each taxpayer is already on the hook for via the original TARP money, the bailout of AIG, Lehman, et al. New total: $19,736 for each and every taxpayer, on average, plus interest.

There’s an additional downside: money invested in the government bonds to subsidize this massive spending is, of course, money which will not be otherwise invested in the economy for such things as actually spurring economic growth: for every dollar invested in a government bond, there’s one less dollar available for private companies looking to grow and expand.

The total amount borrowed for “bailout” spending to date? $2,651,797,108,408.

Investors Say “No” to 87% Tax Hike; Remain on Sidelines…

What would you do if you had the ability to legally avoid an 87% tax hike? Would you avoid the tax hike? Not surprisingly, many investors are answering in the affirmative.

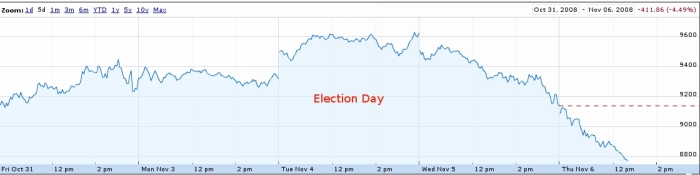

As we previously reported, President Obama campaigned on a promise to increase the capital gains tax from its current 15% to, ultimately, 28% (an increase of 87%). He later called a 33% increase in this tax, from 15% to 20%, “modest”. Investors took heed, and the “Obama effect” on the markets has been evident ever since election day (see chart).

An Open Letter to Obama – Bailout Request #459…

Dear President-Elect Obama and your fellow Democratic lawmakers,

I run a rather large company. We are currently on the threshold of bankruptcy due to the “credit crisis”. This bankruptcy would cause numerous job losses, so as you can imagine, we need help.

Here’s a bit of background on our operations:

We produce a product the general public doesn’t much care for. They can find a better product from our competitors, often at a much better price.

We also pay our employees considerably more than the competition does; about 80% more, in fact.

About a third of all our sales are to our own employees, at heavily discounted prices. Since they’re paying considerably less than the general public, their decision to purchase our products distorts the competitive pressures which would normally exist and which would force us to produce products that the general public would buy.

We’ve faced substantial competition for many years now – decades, actually. But we believe in a consistent business model, to the exclusion of profitability, agile adaptibility and long-term success and viability.

We’re not exactly at the forefront of innovation, but we promise to get there. Maybe. We’ll see.

Our competitors – evil, foreign-based companies – have been moving their plants to the United States. We have countered this invasion by moving our jobs to foreign countries. There, we can overpay our workers too.

Our success is critical to the US economy. After all, just look to history and you’ll see America once had a booming horse and buggy industry. They were allowed to fail when superior competition emerged. The economy has clearly never been the same since.

We need taxpayer money, and lots of it – at the current rate we’re burning through our cash, we’ll be broke soon. We need to be able to burn through taxpayer cash too. And, frankly, if the taxpayers won’t buy our products, we think we should nonetheless take their money. I’m sure you’ll agree that’s reasonable.

As you can see from the points I’ve outlined above, there is clearly nothing wrong with our business model – the robust way in which we do business should not be measured by profitability or long-term viability; nor should the fact no lending institution or investors will lend us money to continue our business as it currently is run be taken to reflect poorly on our management decision and overall strategy. It’s just this “credit-crisis” thing that’s causing us a whole lot of grief. Without that thorn in our side, we’d no doubt be a viable, healthy company.

If you give us the money we are seeking, we’re sure it’ll all turn around – the staggering loss of market share we’ve experienced over the course of the past couple of decades is quite obviously an anomoly which will blow over in due course. Hopefully soon. Hopefully very soon.

Thank you in advance for this bailout. You’ve made the difference between all our workers being laid off and most of our workers being laid off.

Sincerely,

One of Three

Stocks Recovering from ‘Obama Effect’…

Since the day Barack Obama was elected President of the United States, the Dow Jones Industrial Average (DJIA) has been on a deep slide. The Dow closed election day at 9,625.28, then began a nearly daily descent, until it reached 7,552.29 at the closing bell on November 20. That’s a decline of 21.54% in just twelve days, and represents trillions of dollars taken out of the capital markets.

No big surprise there, given that President-elect Obama has promised to increase the Capital Gains tax by 33% (that’s just to start; his stated ultimate goal is a roughly 87% increase in the tax on your investment gains), move the US to a protectionist trade policy and increase regulation.

The markets, however, appear to be starting to shake off the “Obama Effect”: beginning November 21 and continuing for the next five consecutive days, the DJIA has been making up ground, closing November 28 at 8,829.04. That’s more than halfway back to pre-Obama levels.

Could President-elect Obama’s recent comments that he is reconsidering his tax hikes and even contemplating allowing the Bush tax cuts to continue be responsible for some capital returning to the market?

Obama Elected; Stocks Tank…

The Dow Jones Industrial Average closed at 9,625 on Tuesday, November 4, 2008, the day Americans headed to the polls to select their next President, capping a six day rally that had traders thinking the slow path to recovery (or at least relative stability) had begun.

By late Tuesday, it was obvious Senator Barack Obama had won the US Presidential election. Additionally, Democrats took several House and Senate seats, making for a strong (but not quite fillibuster-proof) majority.

The Dow Jones Industrial Average has reacted swiftly and strongly: as of this writing, the DJIA is down to 8,766. That’s a decline of nearly 9% since Mr Obama won the election, and reverses all the gains made during the previous six day rally. That represents over a trillion dollars in capital which has left the market since Mr Obama’s election.

President-elect Obama’s victory is certainly troubling for an economy already on the ropes: he came out in favor of increased protectionism, easier labor union organizing, tax increases on the most productive tax payers, big spending plans on health care, a special tax for successful oil producers and more and bigger government at a time when there isn’t much money to go around and the government has already put taxpayers in the hole for an additional $7,546 each by way of the “bailout” of the financial sector. Additionally, capital is more likely to sit on the sidelines in light of Mr Obama’s proposed 33% increase in the Capital Gains tax (he’s proposed ultimately raising the rate by 87%).

What’s more, Obama and his fellow Democrats will meet very little resistance in imposing their agenda: with the House, the Senate and the Presidency all in Democratic hands (and by wide margins), there’s very little opponents can do to stop wrong-headed policies.

For all the talk of an historic election, recovery for the US economy just got set back considerably: we expect less than 1% growth through 2011, and a contracting economy through all of 2009.

Obamanomics and Taxes: The “Fair” Illusion…

Senator Barack Obama, Nancy Pelosi and other Democrats often talk of making the US tax system more “fair” by imposing additional taxes on higher earners. They argue this segment of the population should be carrying a disproportionally heavier load than the rest of the populace. It’s a very calculated and clever argument: it appeals to envy and social divisions while at the same time jeopardizing only a small segment of voters. But does it have any basis in reality?

Senator Barack Obama, Nancy Pelosi and other Democrats often talk of making the US tax system more “fair” by imposing additional taxes on higher earners. They argue this segment of the population should be carrying a disproportionally heavier load than the rest of the populace. It’s a very calculated and clever argument: it appeals to envy and social divisions while at the same time jeopardizing only a small segment of voters. But does it have any basis in reality?

When it comes to the US tax system, the wealthy already pay an astonishingly disproportionate share of all tax revenues. Take, for example, the top two percent of all earners: this group pays an incredible 43.6% ¹ of all personal federal income taxes. Yes, you read that right: two percent carry nearly half the load.

Well, you might argue, if they make 43.6% of all income, then that seems reasonable. Not even close: the top two percent of all earners take in 24.1% of all income.

The bottom 50% of all earners contributes a mere 3.3% of all federal income taxes (while earning 13.4% of all income).

Let’s drill down a little further and look at the top five percent: Senator Obama has called on increasing the taxes on this group, and he has defined them as earning $250,000 or more per annum (since then, he’s adjusted that to $200,000 in a television ad; his running mate, Senator Joe Biden, uses $150,000). What do the numbers say about this group?

Well, Senator Biden is closer to the truth than Senator Obama: the top five percent of all earners make $137,056 a year. They currently contribute, wait for it, 57.1% of all federal income taxes. Can it truthfully be said they are not carrying their fair share?

Britain experimented with similar wealth-redistribution schemes in the ’70s: the top earners were subjected to a 90% (yes, ninety-percent!) tax rate. What happened as a result? They left.

An Open Letter to Senator Obama…

Senator Obama,

You spoke today about your plan to increase capital gains taxes from 15% to 20%. You referred to it as a “modest increase”.

Sir: most people, even most Democrats, do not consider a 33% increase in taxes “modest”.

You’ve also spoken about your intent not to raise taxes on the so-called “middle-class”.

These two statements are incompatible: over 100,000,000 Americans will be affected by your 33% tax increase (which you’ve previously said you’d ultimately raise to 28%, which would be a total tax increase of 87%). People who are relying on their retirement investments will be affected. People invested in mutual funds will be impacted. Hard working people who rely on their union-negotiated pension will be affected, since those same pensions invest in the markets.

Further, at a time when capital has retreated on a wholesale basis from the markets, threatening the entire economy and making investments by companies in job-creating growth virtually impossible, do you truly believe new barriers to capital are prudent economics?

Senator Obama, please, please reconsider this course of action. Neither the American people nor the economy can reasonably be expected to sustain a 33% tax hike, and while ideology is a fine thing in extremely small doses, now isn’t the time to impose it, regardless of how tempting control of all arms of the Legislative and Executive branches of government may make it.