Posts Tagged ‘US election’

Ron Paul Gaining Momentum? Georgia Straw Poll Suggests So…

Some interesting developments on the campaign trail indeed: in the Georgia GOP straw poll of Presidential hopfefuls, some media-annointed heavyweights fared very poorly, while the candidate the media loves to ignore, Ron Paul, again finished within a percentage point of winning the poll, narrowly losing to straw poll winner Herman Cain, who captured 26% of votes against 25.7% for Dr Paul (see our article, “Is Ron Paul Getting a Fair Shake From the Media? Watching the Watchers…” for our analysis of media coverage granted Mr Paul relative to the other candidates and also relative to his showing in the Iowa straw poll). Notably, Herman Cain is a native of Georgia, giving him the home town advantage (Mr Cain received 8% of the vote in the Iowa straw poll, against 27% for Ron Paul).

Some interesting developments on the campaign trail indeed: in the Georgia GOP straw poll of Presidential hopfefuls, some media-annointed heavyweights fared very poorly, while the candidate the media loves to ignore, Ron Paul, again finished within a percentage point of winning the poll, narrowly losing to straw poll winner Herman Cain, who captured 26% of votes against 25.7% for Dr Paul (see our article, “Is Ron Paul Getting a Fair Shake From the Media? Watching the Watchers…” for our analysis of media coverage granted Mr Paul relative to the other candidates and also relative to his showing in the Iowa straw poll). Notably, Herman Cain is a native of Georgia, giving him the home town advantage (Mr Cain received 8% of the vote in the Iowa straw poll, against 27% for Ron Paul).

Candidate Mitt Romney, the former Governor of Massachusetts, who is widely considered to be the eventual GOP Presidential candidate (even among Obama’s staff), finished with just 6% of the straw poll votes. Michele Bachmann, whom Fox News described as having “cemented her top-tier position” after the Iowa straw poll, finished with just 3%. Rick Perry, the former Texas Governor who officially announced his candidacy the day of the Iowa straw poll, finished 5.7 percentage points (or over 22%) behind Dr Paul.

It will be interesting to see the reaction from media outlets to Ron Paul’s latest strong showing (notably, he also polls neck-and-neck with Obama). We’ll be tracking media coverage of this result as part of our ongoing series monitoring the even-handedness of US political coverage.

Let the Mud Slinging Begin: US News & World Report Attacks Ron Paul…

Further to our article examining the media’s treatment of Ron Paul, there’s an amusing article in US News & World Report today: a person who they identify as a Ron Paul “supporter” has “announced” he will be placing an ad asking people (“Are you a stripper, an escort or just a ‘young hottie'”) to come forward who have had sex with Texas Governor and Presidential hopeful Rick Perry. The article is titled “Sex Ad Hurts Ron Paul More Than Rick Perry” and is written by Peter Roff.

Let’s examine this a bit further:

- No ad has yet been placed – the person has simply “announced” the intention to place such an ad. I am announcing that I am twenty-three feet tall and excel at badminton (neither statements is true, but I am “announcing” them nonetheless);

- The person (Robert Morrow) is described as a Ron Paul “supporter”. Note that this differs significantly and materially from a Ron Paul “representative” or “agent”. Are there people who voted for Obama (ie “supporters”) who have subsequently raped children? I suppose there could well be; that does not make such a person a “spokesman” for, or a “representative” of, Obama. Same applies here;

- The article goes on to state: “The Paul supporters are known to be a dedicated bunch—some might even call them fanatics”. US News and World Report is known to be a fringe media source. Some might even call them flat out paid shills. See what we did there?

- Have a look at the title of the article: “Sex Ad Hurts Ron Paul More Than Rick Perry”. There is no sex ad, Ron Paul’s campaign has nothing to do with the supposed ad, and even if the ad existed, we do not know if it would hurt Mr Paul more than Mr Perry, or Mr Perry more than Mr Paul, or both equally or not at all.

The article is, in short, a public relations piece – in this case, an anti-Ron Paul bit of PR.

By way of background, US News & World Report is a declining media property (they reduced their print publications repeatedly, before abandoning regular print runs entirely as of December 2010), whose Editor-In-Chief, Mortimer B. Zuckerman (real estate tycoon worth an estimate $2.1bn USD and noted supporter of Jewish causes), is a significant contributor to Democrats (of a reported $63,000 in campaign contributions, Mr Zuckerman gave $42,700 to Democrats and most of the balance to independents. He also contributed to Senator Al Franken’s (D – Minnesota) recount fund, Gary Hart’s (D) Presidential campaign and contributed at least once to Senator Edward Kennedy’s (D) Presidential run (as well as at least three other contributions to Senator Kennedy’s runs for the Senate)). Mr Zuckerman once claimed to have helped write an Obama speech, before backtracking. Some might say he is a mouthpiece of the Democratic Party.

Stocks Recovering from ‘Obama Effect’…

Since the day Barack Obama was elected President of the United States, the Dow Jones Industrial Average (DJIA) has been on a deep slide. The Dow closed election day at 9,625.28, then began a nearly daily descent, until it reached 7,552.29 at the closing bell on November 20. That’s a decline of 21.54% in just twelve days, and represents trillions of dollars taken out of the capital markets.

No big surprise there, given that President-elect Obama has promised to increase the Capital Gains tax by 33% (that’s just to start; his stated ultimate goal is a roughly 87% increase in the tax on your investment gains), move the US to a protectionist trade policy and increase regulation.

The markets, however, appear to be starting to shake off the “Obama Effect”: beginning November 21 and continuing for the next five consecutive days, the DJIA has been making up ground, closing November 28 at 8,829.04. That’s more than halfway back to pre-Obama levels.

Could President-elect Obama’s recent comments that he is reconsidering his tax hikes and even contemplating allowing the Bush tax cuts to continue be responsible for some capital returning to the market?

Obama Elected; Stocks Tank…

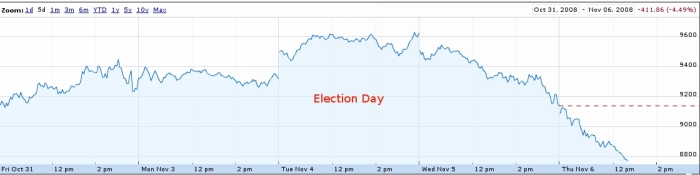

The Dow Jones Industrial Average closed at 9,625 on Tuesday, November 4, 2008, the day Americans headed to the polls to select their next President, capping a six day rally that had traders thinking the slow path to recovery (or at least relative stability) had begun.

By late Tuesday, it was obvious Senator Barack Obama had won the US Presidential election. Additionally, Democrats took several House and Senate seats, making for a strong (but not quite fillibuster-proof) majority.

The Dow Jones Industrial Average has reacted swiftly and strongly: as of this writing, the DJIA is down to 8,766. That’s a decline of nearly 9% since Mr Obama won the election, and reverses all the gains made during the previous six day rally. That represents over a trillion dollars in capital which has left the market since Mr Obama’s election.

President-elect Obama’s victory is certainly troubling for an economy already on the ropes: he came out in favor of increased protectionism, easier labor union organizing, tax increases on the most productive tax payers, big spending plans on health care, a special tax for successful oil producers and more and bigger government at a time when there isn’t much money to go around and the government has already put taxpayers in the hole for an additional $7,546 each by way of the “bailout” of the financial sector. Additionally, capital is more likely to sit on the sidelines in light of Mr Obama’s proposed 33% increase in the Capital Gains tax (he’s proposed ultimately raising the rate by 87%).

What’s more, Obama and his fellow Democrats will meet very little resistance in imposing their agenda: with the House, the Senate and the Presidency all in Democratic hands (and by wide margins), there’s very little opponents can do to stop wrong-headed policies.

For all the talk of an historic election, recovery for the US economy just got set back considerably: we expect less than 1% growth through 2011, and a contracting economy through all of 2009.

Obamanomics and Taxes: The “Fair” Illusion…

Senator Barack Obama, Nancy Pelosi and other Democrats often talk of making the US tax system more “fair” by imposing additional taxes on higher earners. They argue this segment of the population should be carrying a disproportionally heavier load than the rest of the populace. It’s a very calculated and clever argument: it appeals to envy and social divisions while at the same time jeopardizing only a small segment of voters. But does it have any basis in reality?

Senator Barack Obama, Nancy Pelosi and other Democrats often talk of making the US tax system more “fair” by imposing additional taxes on higher earners. They argue this segment of the population should be carrying a disproportionally heavier load than the rest of the populace. It’s a very calculated and clever argument: it appeals to envy and social divisions while at the same time jeopardizing only a small segment of voters. But does it have any basis in reality?

When it comes to the US tax system, the wealthy already pay an astonishingly disproportionate share of all tax revenues. Take, for example, the top two percent of all earners: this group pays an incredible 43.6% ¹ of all personal federal income taxes. Yes, you read that right: two percent carry nearly half the load.

Well, you might argue, if they make 43.6% of all income, then that seems reasonable. Not even close: the top two percent of all earners take in 24.1% of all income.

The bottom 50% of all earners contributes a mere 3.3% of all federal income taxes (while earning 13.4% of all income).

Let’s drill down a little further and look at the top five percent: Senator Obama has called on increasing the taxes on this group, and he has defined them as earning $250,000 or more per annum (since then, he’s adjusted that to $200,000 in a television ad; his running mate, Senator Joe Biden, uses $150,000). What do the numbers say about this group?

Well, Senator Biden is closer to the truth than Senator Obama: the top five percent of all earners make $137,056 a year. They currently contribute, wait for it, 57.1% of all federal income taxes. Can it truthfully be said they are not carrying their fair share?

Britain experimented with similar wealth-redistribution schemes in the ’70s: the top earners were subjected to a 90% (yes, ninety-percent!) tax rate. What happened as a result? They left.

An Open Letter to Senator Obama…

Senator Obama,

You spoke today about your plan to increase capital gains taxes from 15% to 20%. You referred to it as a “modest increase”.

Sir: most people, even most Democrats, do not consider a 33% increase in taxes “modest”.

You’ve also spoken about your intent not to raise taxes on the so-called “middle-class”.

These two statements are incompatible: over 100,000,000 Americans will be affected by your 33% tax increase (which you’ve previously said you’d ultimately raise to 28%, which would be a total tax increase of 87%). People who are relying on their retirement investments will be affected. People invested in mutual funds will be impacted. Hard working people who rely on their union-negotiated pension will be affected, since those same pensions invest in the markets.

Further, at a time when capital has retreated on a wholesale basis from the markets, threatening the entire economy and making investments by companies in job-creating growth virtually impossible, do you truly believe new barriers to capital are prudent economics?

Senator Obama, please, please reconsider this course of action. Neither the American people nor the economy can reasonably be expected to sustain a 33% tax hike, and while ideology is a fine thing in extremely small doses, now isn’t the time to impose it, regardless of how tempting control of all arms of the Legislative and Executive branches of government may make it.

Obama’s Proposed 87% Increase to Capital Gains Tax Exactly What the Economy Doesn’t Need…

Senator Barack Obama has proposed moving the Capital Gains Tax from its current 15% rate to 28%, an increase in the tax rate totalling a shocking 86.6%. It couldn’t come at a worse time.

Senator Barack Obama has proposed moving the Capital Gains Tax from its current 15% rate to 28%, an increase in the tax rate totalling a shocking 86.6%. It couldn’t come at a worse time.

While trillions of dollars in capital has disappeared from the markets, adding a dis-incentive for investors to return to the markets is a sure-fire strategy for lengthening the current downturn. And when companies cannot readily access capital, they can’t build new plants, take on R&D expenditures or do all those other things that lead to the people on “Main Street” gaining access to new jobs.

What’s worse is that Mr Obama does not seem to understand the fundamental difference between a tax rate and tax revenue: changes in tax rates lead to changes in the way people behave. For example, Presidents Ronald Reagan, Bill Clinton and George W. Bush all cut the Capital Gains Tax. Under Clinton, it was 28%. Under George W. Bush it sits at 15%. After each of these tax cuts, tax REVENUE actually increased.

The kind of increase Mr Obama proposes therefore has a dual negative effective with no discernible upside: investment capital stays out of the market and government revenues from the Capital Gains Tax shrink.

So why would Senator Obama consider such an ill-fated move? He thinks it’s “fair”.

You can see Mr Obama’s explanation in the video below – note Jim Lehrer, the moderator, attempt three times to explain to Senator Obama that tax revenue decreases as the Capital Gains Tax increases.

How McCain Blew His Golden Opportunity…

In a week of shocking developments, including a defeated bill which sought new government spending in excess of the defense budget (and, in fact, any single item of the general budget), Senator John McCain blew a golden opportunity to put his well advertised but difficult to discern “maverick” reputation on the line on behalf of the majority of american people.

In a week of shocking developments, including a defeated bill which sought new government spending in excess of the defense budget (and, in fact, any single item of the general budget), Senator John McCain blew a golden opportunity to put his well advertised but difficult to discern “maverick” reputation on the line on behalf of the majority of american people.

While the Democratic party, and Senator Barack Obama, and President Bush and many Republicans believe artificially increasing the supply of credit by way of government intervention at the expense of more than $7,000 for every taxpayer (and with all the urgency of a stick up artist poking his gun in your ribs and demanding your wallet) is a prudent idea, the bulk of the US population believe otherwise.

They’re right.

Contrary to virtually all media reports, government interventionism led directly to the current “crisis”. Despite this, the only solution proposed revolves around additional government intervention. Media “pundits” notwithstanding, “Main Street” understands the profound hypocrisy at play here. Unfortunately, in an election year featuring one candidate deeply commited to government interventionism and another candidate desperately commited to the idea that a leader should be seen to be doing something, even if that something is the wrong thing, the majority of americans have no one representing their views, or their pocket book.

John McCain has shown a shocking lack of courage in not standing up to the special interests who support the proposed government bailout. These same special interests, who routinely espouse the merits of free enterprise (but only when free enterprise works to their advantage) and are now calling for government intervention on a scale never before seen. John McCain supports their pleas.

There was another path for Mr McCain to take. He could have, for example, told the american people that the solution was for the government to get out of the business of guaranteeing low-quality loans. He could have said that the time for government to subsidize irresponsibility, be it on a personal level or institutionally, has long since passed. He could have made the case that picking the pockets of the people on so-called Main Street to subsidize Wall Street is profoundly un-american. He could even have put forth the (shocking, these days) notion that government is not, in fact, the solution to each and every problem. Instead, he seems to have charted a course intended to appear as “leadership”, but which leaves angry, financially threatened americans with no alternatives among Presidential candidates on the critical issue of a government bailout.

This is an issue with profound implications. Not just for americans today, but also for their children and grand children. In a country which espouses the freedom of the individual above all, but which increasingly proves the concept to be lip service at best, the populace has a choice of a “change agent” or a “maverick”, both of whom lack the courage to plot anything resembling a new course.

Land of the free? Home of the brave? Not anymore…

Obama’s Fundamental Problem…

Barack Obama, perhaps giving a shout-out to law firms with lobbying ties, among his biggest contributors?

There’s no other way to look at it: the 2008 US election should be an absolute cakewalk for the Democrats: a profoundly disliked president, an economy in a crisis not seen since the late 1920s, an unpopular war, US global influence vastly diminished, a currency weaker than it’s been in a generation and eight solid years of a Republican presidency.

And yet, in recent polls, Republican Presidential nominee John McCain, disliked by his own party’s most faithful (in multiple senses of the word…), is starting to gain a small lead. What gives?

The problem is fundamental to Democrats: on the whole, the population of the United States does not embrace Democratic philosophy, and the Democratic party itself is a collection of such deeply divergent special interests that keeping a coalition happily united is a near impossible task.

On the first point, the bulk of the US population does not agree with the fundamental principle of Democratic policies: that it is a just course of action to take from many to pay for the chosen few on ideological grounds. In fact, the “founding fathers” of the US said as much: to quote Thomas Jefferson, “The democracy will cease to exist when you take away from those who are willing to work and give to those who would not.”

The majority of people in the US are willing to look after themselves, work hard and honestly don’t expect the government to provide the solution to every last inconvenience.

Take the mortgage crisis: while Barack Obama (and the Democratic Congress) pushed for a government bailout of the banks (ostensibly under the guise of helping the distressed home owners, however keep in mind it’s the banks who lose on a grand scale when mortgages default), Mr. McCain had a very different message: why should you, as a responsible homeowner, have to pay for your neighbour’s error in judgement in taking on an ultimately unserviceable mortgage?

You’d think Mr. Obama and the rest of the Democrats would gain an awful lot of traction with their “we’ll save you” message. However they miscalculated the math: their “solution” imposes a burden on 95% of the population for the benefit of the 5% of the population who quite willingly and freely chose to over-extend themselves. While on the surface you’d think Mr. Obama’s message would have massive popular appeal, the Democrats simply don’t have the numbers.

They likewise have a problem hanging their case for the White House on President Bush’s unpopularity. Why? Because the only thing statistically more unpopular among Americans than President Bush is the Democratic Congress! The Democratic message, repeated ad infinitum, of Mr. McCain being simply an extension of President Bush has rung hollow from the get-go: if you’re going to make the case that your opponent is simply a mirror image of the current President by virtue of the fact he voted with the President 90% of the time, you’d best first ensure your record doesn’t reflect a voting record that obediently voted with your even more unpopular Congressional colleagues 97% of the time!

Clearly Mr. Obama’s advisors see Mr. McCain’s reputation for independence as a very significant threat to their candidate’s image as an agent of change. Unfortunately in doing so, they expose Mr. Obama to charges that he’s anything but an agent of change, opening the door for Mr. McCain to point to his rival’s hardly-inspiring record of simply going along with his party during his three years in office.

On the second point, the Democrats are a party based on reconciling irreconcilable differences: their supporters include union members (read: union leaders), but also the “environmentalists” who oppose exactly the kind of industries who lend themselves to a unionized workforce. An overwhelming majority of lawyers support the Democrats by virtue of the party’s opposition to punitive damage caps, but at the same time they seek to appeal to Jack and Jane Blue Collar, hardly a constituency enamored of rich lawyers who enjoy a lavish lifestyle based largely on attacking large employers of union folk. Those same hard working, blue collar supporters find themselves supporting the same party as vaccuous Hollywood stars, for whom it’s important to be seen as egalitarian as they phone in their donations while ensconced in their multi-million dollar homes.

Mr. Obama’s San Francisco comments about “people clinging to guns and religion” is very telling: this is a party which, at its root, attempts to appeal to the disenfranchised only for the purpose of getting power so that they can subsequently get to the more important task of imposing ideologies. It’s no different than Mr. Obama making speeches about “protecting” blue collar jobs by way of protectionist policies while his representatives simultaneously approach the Canadian government to reassure them it’s all just talk and they needn’t get nervous about existing trade agreements, despite their candidate’s insistence he will “renegotiate” those same agreements.

The bigger problem Barack Obama and the Democrats face is the sophistication of the voters: the Democratic message of the government as the solution for all the populace’s woes doesn’t ring true to a population who has seen it all before and is familiar with the results. If government intervention was truly the answer, wouldn’t pre-open-economy China, the old Soviet Union and, more recently, Venezuela be paradises for their people?

Finally, the Democratic leadership seems to have an oddly myopic view of reality: they appear to only associate with other Democrats and in so doing get a distorted view of their own popularity. Their hubris has bitten them many times before: both Mr. Gore and Mr. Kerry were widely considered shoe-ins – it was incomprehensible that they should lose. Far-left Democratic supporters (think Michael Moore et al) were utterly dumb-struck that their candidate could have lost in ’00 and even more so in ’04. However a look at an electoral map should have given them a heads up: it’s only in areas of particularly dense population that Democratic philosophies gain traction. By land mass, the United States overwhelmingly embraces Republican political philosophies (as difficult as those philosophies are to define when you have a Republican President who spends more and grows government larger than any Democrat has).

It must be tough times indeed for any clear-eyed Democratic supporter: circumstances have aligned in a way that ought to leave them planning a victory parade rather than worrying about the messy business of campaigning. And yet, the more the voters learn of their candidate, the worse the poll results become. Meanwhile, in a climate ripe for a message of change, the Democratic candidate finds himself up against an opponent who has more (and proven) credibility as an actual change agent.

At heart, most Americans really just want the government to leave them alone and let them get about the business of working hard and providing for their own needs and the needs of their families. For these voters, the only thing worse than being told what to do is being told what to do by the government, regardless of how elequently those orders are conveyed…